-

Set up a company

-

Portugal

- Why Set Up a Company in Portugal?

- How to Set Up a Company in Portugal

- Types of Companies in Portugal

- Taxation of Companies in Portugal

- Obligations of Companies in Portugal

-

Madeira

- Advantages of Setting Up a Company in Madeira

- The International Business Centre of Madeira

- Registration of Ships in Madeira

-

Malta

- Why set up a company in Malta?

- How to set up a company in Malta

- Types of Companies in Malta

- Taxation of companies in Malta

-

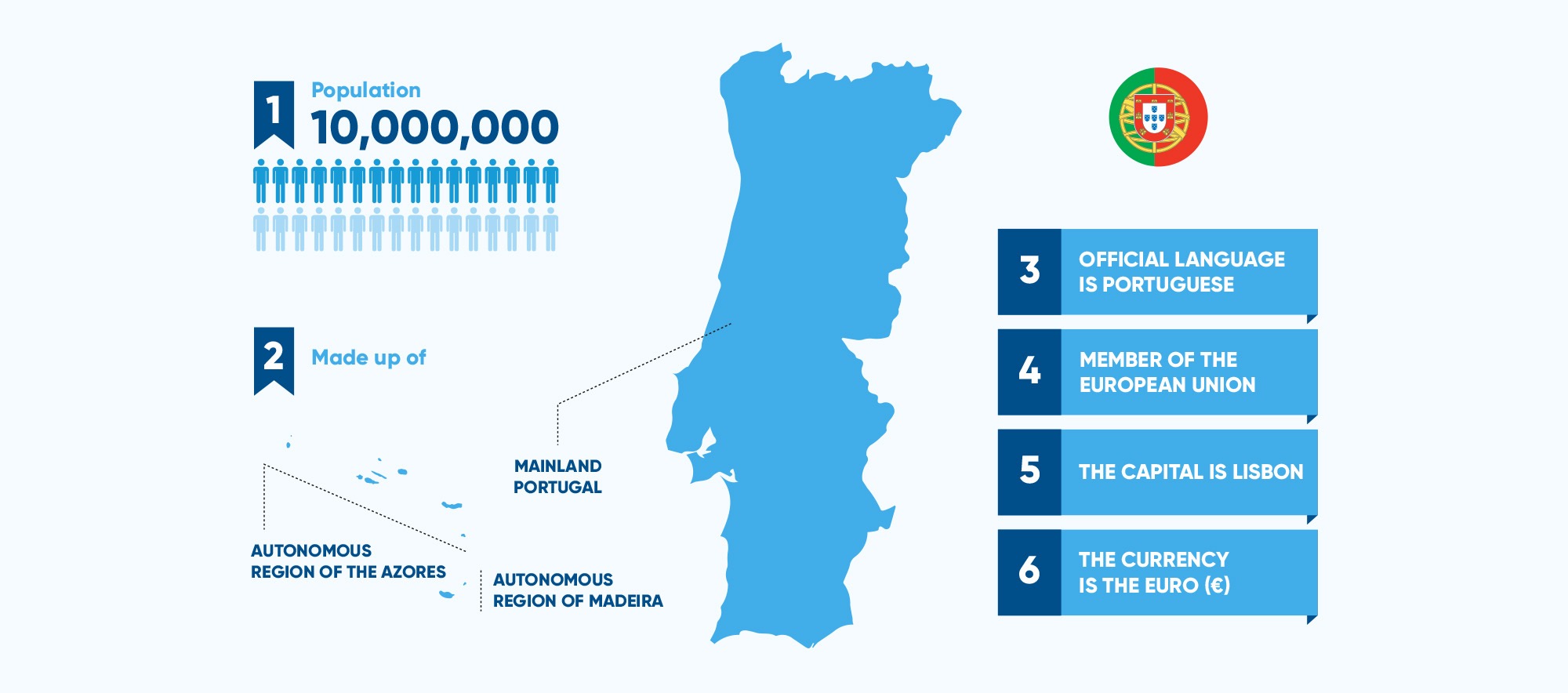

Portugal

-

Moving to Portugal

- Living in Portugal

- Living in Madeira

-

How to move to Portugal

- How to get a NIF (taxpayer number) in Portugal

- How to open a bank account in Portugal

- Residence Visas for Portugal

- Taxes in Portugal

- Tax Incentives for New Residents

- Tax obligations in Portugal

-

Working in Portugal

-

Resources

- Articles

- Guides

-

Tax and Accounting Information

- Taxation in Portugal

- Companies in Portugal

- Taxation in Madeira

- Madeira companies

- Taxation in Malta

- Companies in Malta

-

NEWCO

- Our Services

-

Our Team

- Leadership

- Country Managers

- Compliance

- Accounting and Tax Compliance

- Client Management and Marketing

- Administrative Services

- Real Estate Services

- Legal Department

- IT and Technical Support

- Contacts